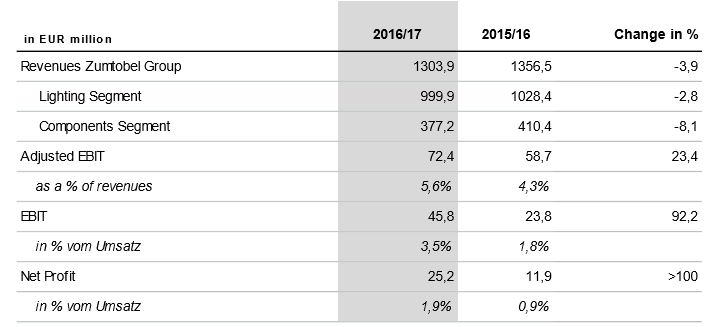

FX-adjusted Group revenues 1% below prior year

Adjusted EBIT rises by 23.4% to EUR 72.3 million

Net profit for the year more than doubled year-on-year (from EUR 11.9 million to EUR 25.2 million)

Significant improvement in free cash flow to EUR 69.4 million

Technology position strengthened: investments in R&D total EUR 82.4 million

Outlook: improvement in revenues and earnings anticipated

In the 2016/17 financial year the Zumtobel Group posted a marked improvement in earnings and was able to more than double its net profit year-on-year to EUR 25.2 million. While profitability was increased, revenues were impacted by negative currency effects and a challenging business environment.

“The past financial year was a very successful one for the Zumtobel Group. We are clearly on the right track with the measures that we have implemented to improve our competitive position. The comprehensive restructuring undertaken in recent years has helped us achieve a significant increase in profitability. One key milestone for the company in the 2016/17 financial year was the market launch of Zumtobel Group Services (ZGS). This enables us to position the Group as a full-line supplier of lighting solutions and software-oriented services. We are convinced that we have laid stable foundations for profitable growth and that, thanks above all to the commitment of our employees, we will reach our growth targets,” said Zumtobel Group CEO Ulrich Schumacher.

| (Image: Zumtobel Group) |

Revenues impacted by negative currency effects

Revenue development in the 2016/17 financial year was influenced by substantial negative currency effects of EUR 39.0 million, above all due to the appreciation of the euro versus the British pound. Another contributory factor was the absence of revenues from the signage business, which was sold in November 2015. As a result, the Group recorded a year-on-year decline of 3.9% in revenues to EUR 1,303.9 million (2015/16: EUR 1,356.5 million) in a lighting industry environment that was both challenging and highly volatile. Revenues from the sale of LED products continued their dynamic growth, as illustrated by a year-on-year increase of 11.6% to EUR 960.0 million (2015/16: EUR 860.3 million). Thus, over the 12-month period, the LED share of Group revenues rose to 73.6% (2015/16: 63.4%).

Increase in profitability and improvement in free cash flow

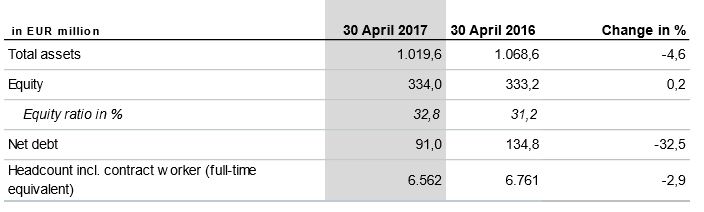

The most important highlight of the Zumtobel Group’s 2016/17 financial year was the improvement in earnings: Group EBIT adjusted for special effects rose by 23.4% year-on-year from EUR 58.7 million to EUR 72.4 million in spite of the decline in revenues. Consequently, the return on sales improved from 4.3% to 5.6%. Net profit for the year more than doubled, rising from EUR 11.9 million in the previous financial year to EUR 25.2 million. The measures undertaken to optimize the Zumtobel Group’s global integrated production network made a decisive contribution to the lighting group’s increased profitability. The planned construction of a new production plant in Serbia will further support this upward trend going forward.

A further very positive development was recorded in terms of free cash flow. Strict working capital management, lower capital expenditure, as well as a better operating result led to positive free cash flow of EUR 69.4 million (2015/16: EUR 49.8 million). In view of these developments, the Management Board will make a recommendation to the Supervisory Board and, subsequently, to the annual general meeting on 21 July 2017, calling for distribution of a EUR 0.23 dividend per share for the 2016/17 financial year (2015/16: EUR 0.20).

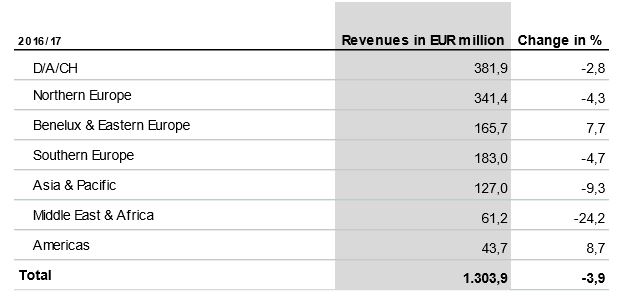

Different regional trends and developments in the two segments

A global comparison reveals different developments in the various regions. Very sound revenue growth in the Benelux & Eastern Europe region, as well as in Austria, the USA, the UK and Italy contrasted with clear, largely market-led declines in Australia, France, Switzerland and especially in the Middle East. Against this backdrop, revenues in the Lighting Segment (acdc, Thorn, Reiss and Zumtobel brands) declined by 2.8% to EUR 999.9 million (2015/16: EUR 1,028.4 million). The decline in the Components Segment was more pronounced than in the Lighting Segment at minus 8.1% for 2016/17. This resulted from the revenues lost due to the sale of the Group’s signage activities and from the continuing sharp decline in revenues from the sale of conventional electronic ballasts. On the positive side, there was sound growth in the demand for smart, connectable LED components and system solutions from Tridonic.

Investing in the future of light

To drive its strategic redirection in the field of data-based services, the Zumtobel Group maintained its investments in research and development (R&D) at a virtually unchanged level. Thus in 2016/17 the lighting group invested EUR 82.4 million in R&D to further strengthen its technology position. This is reflected not least in the Group’s extensive portfolio of patents. In the year under review, 161 patent applications were filed (2015/16: 141). In all, the Zumtobel Group currently holds more than 4,700 patents. The current focus in the R&D sector is on the topic of connected lighting within the Internet of Things. The past financial year saw the Zumtobel Group bring its first products to market in this field and successfully implement initial projects. These included the connected lighting systems which the Zumtobel Group installed in several rooms at the London headquarters of Land Securities Group PLC, the UK’s largest commercial property company. The aim is to work together with the customer to unlock the benefits that connected lighting can offer for commercial buildings.

Global headcount totals 6,562 full-time equivalents

The strategic reorientation of the Zumtobel Group and the related necessary restructuring measures led to a decline in the workforce, particularly in the production sector. On 30 April 2017, the Zumtobel Group had 6,562 full-time employees worldwide (including contract workers, not including apprentices). This equates to a year-on-year decline of some 200 employees. The headcount in Austria increased by 5.1% year-on-year to 2,430 full-time equivalents. The size of the workforce in the Vorarlberg region rose by 6.3% to 2,157 employees. On 30 April 2017 the Zumtobel Group was training a worldwide total of 113 apprentices.

Outlook: improvement in revenues and earnings anticipated

The Management Board aims to pursue the chosen course of strategic reorientation with full commitment and dedication during the coming financial year. The focus will be placed on the one hand on further improving the Zumtobel Group’s cost position, for example through the construction of a new production plant in Serbia, and on the other hand on investments in future-oriented technologies in the Internet of Things and the expansion of the newly created service division. In the European construction industry, the signs of a trend reversal from a period of decline to slight market growth were confirmed during the year under review, although with major regional differences. The Zumtobel Group will continue to benefit from the substantial improvement in its cost position during 2017/18, but also expects to see additional negative factors in unfavourable currency effects, pressure on prices in the Components Segment and extensive investments in the key topics of the future.

In spite of the continuing limited visibility, the Management Board of the Zumtobel Group expects a slight improvement in revenues (2016/17: EUR 1,303.9 million) and adjusted Group EBIT (2016/17: EUR 72.4 million) for the full 2017/18 financial year. Thus the Zumtobel Group remains on track to gradually raise the adjusted EBIT margin to roughly 8% to 10% over the medium-term.

| (Source: Zumtobel Group) |

(Source: Zumtobel Group)